This time last year Miningmx commented that 2025 would be a “make or break” year for Northern Cape junior miner Copper 360 and, unfortunately, it has turned out to be “break”.

Results for the year to end-February – released at the end of June – revealed that its loss had trebled to R223m from a loss of R64.8m the previous year and, remember, that prior loss was supposed to be a profit of R245m.

The accumulated losses incurred so far have resulted in the auditors declaring an “emphasis of matter” querying Copper 360’s ability to carry on as a going concern. That was rejected by the directors who maintain the group is “in a sound financial position and has access to sufficient borrowing facilities to meeting its foreseeable cash requirements”.

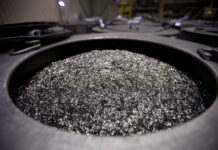

All of this resulted from Copper 360’s most damning failure, which was its inability to produce the copper it said it would. The company produced just 1,054 tons of copper for the year against prior forecasts it would produce “at least” 6,000t.

Copper 360 reported that it had placed its SX-EW copper cathode plant into care and maintenance because of operating losses while its MFP2 recovery plant reached operating capacity only in the second half of the financial year.

The company is now being run by

its third CEO in seven months. Founding CEO Jan Nelson was abruptly replaced in December by Copper 360 chair and controlling shareholder Shirley Hayes. The stated reason was “the implementation of the transition to producing status ensuring integrated collaboration and disciplined execution and risk management”.

Nelson was appointed “executive director of resource strategy and equity value” to oversee the programme to open up new mines in terms of Copper 360’s cluster mining strategy, but he has been effectively out of action since December because of serious health issues.

Hayes stayed CEO until the beginning of June, when she brought in retired former Harmony CEO Graham Briggs to run Copper 360 and reverted to a non-executive director role.

A Copper 360 statement said the leadership change underscored her continued commitment to the company’s “growth and success, ensuring the insights and leadership she has provided to date remain available to Copper 360”.

Hayes tells Miningmx her role as CEO was “to fill a void and stabilise the company during a transitional period. Vision and grit built this company. Now we have brought in the leadership to deliver.”

Briggs has wasted no time in cutting through the corporate verbiage published so far and confronting the reality that Copper 360 is up against, which will require further funding to deal with.

The bottom line is that the prior forecasts made for Copper 360’s performance to date were wildly optimistic.

Nelson had guided a huge jump in copper production to at least 6,000t for the year to end-February from just 1,500t in the previous financial year, as well as the payment of an initial dividend.

The company expected to produce this copper from the Rietberg underground mine as well as its SX-EW plant and planned to have three recovery plants in operation by August 2024, which would be SX-EW, MFP2 and MFP1.

The Rietberg mine – which was supposed to transform copper production during the financial year – fell horribly short of expectations for a number of reasons.

These included the delay to the start of operations at the mine; the delay in capitalising the mine through providing the mining fleet and infrastructure; and the “prolonged tramming of broken rock and transitional ore at lower and inconsistent grades that also causes lower recoveries at the processing plant”.

Getting the SX-EW plant back to profitability will require a “second phase upgrade” to significantly increase output but the capital required to pay for this is only going to be allocated once the concentrate operations at Rietberg “are operating at a sustainable level”, he says.

Briggs now says he expects operations to reach an “annualised” production rate of 5,000t of copper “within six to 12 months”, which would come from reaching a throughput of 40,000t of copper ore a month at a grade of 1%.

He rejects suggestions that Copper 360 is a failing company, saying that it is resource-rich, lightly capitalised and only starting its transition to production with the Rietberg mine.

“I believe I can get this company back on its feet, but it’s going to be hard work,” he comments. Briggs says priorities are to get Rietberg up to full production and then to open up another mining operation, as well as complete the MFP1 processing plant, which he says is 85% finished.

“Rietberg is a trackless mining operation and it needs capital for equipment and then we need to get another mine going for continuity of production. Once those are going then it’s a case of getting consistent results.”

Briggs declined to specify at this stage how much money Copper 360 would need to raise but indicated it would likely have to come through the issue of new equity.

He commented, “When you are in a situation like this you have to look at what you can afford and we are looking at equity as opposed to knocking on doors at banks to get loans.

“It will be a significant amount of money and it is likely to come from new shareholders. Our current dominant shareholders would probably not want to follow any rights offer.”

Copper 360’s shareholders include Hayes – who has 58% – Coronation and the Ekapa consortium.