Techmet’s growth in critical minerals production, processing and marketing is likely to get “bigger and quicker” with the backing of the Trump administration, says TechMet founder and CEO Brian Menell.

That’s a positive for South Africa because Menell, the grandson of Anglovaal co-founder Slip Menell, is less likely than most international investors to exclude the country’s turbid mining sector from the list of potential TechMet destinations.

TechMet is an investment company valued at over $1bn that sources developing or producing assets in critical minerals (lithium, nickel, cobalt, vanadium, tin, rare earths and tungsten) and takes either controlling or dominant minority stakes. Its significant investors include the US International Development Finance Corporation and the Qatar Investment Authority, both of which are keen to diversify critical minerals sourcing away from China.

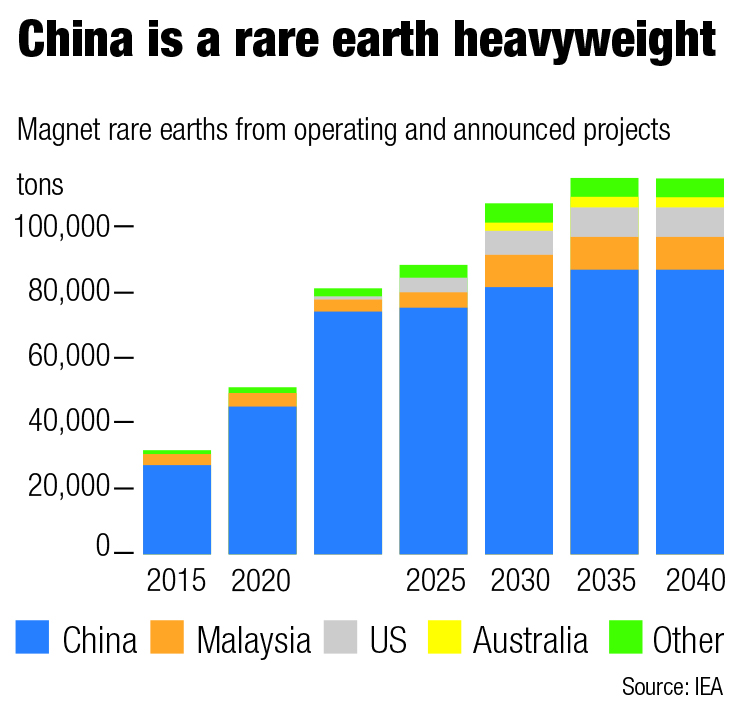

China currently controls around two-thirds of the production or processing of critical minerals such as lithium, graphite, cobalt and nickel, and over 90% of that of rare earth elements (REEs), according to an RBC blog in April 2025, ‘The New Great Game: how the race for critical minerals is shaping tech supremacy’. If China were to cut off or hike the prices of these minerals to its buyers, it would wreak havoc with the global aerospace, defence, transport, energy and communications sectors.

President Donald Trump has made critical minerals sourcing an important element of his policies since his first period in office, primarily to accelerate domestic mining and processing. In his first term, Trump signed an executive order defining 35 minerals as essential to national interests. The Biden administration followed with funding support for domestic critical minerals projects.

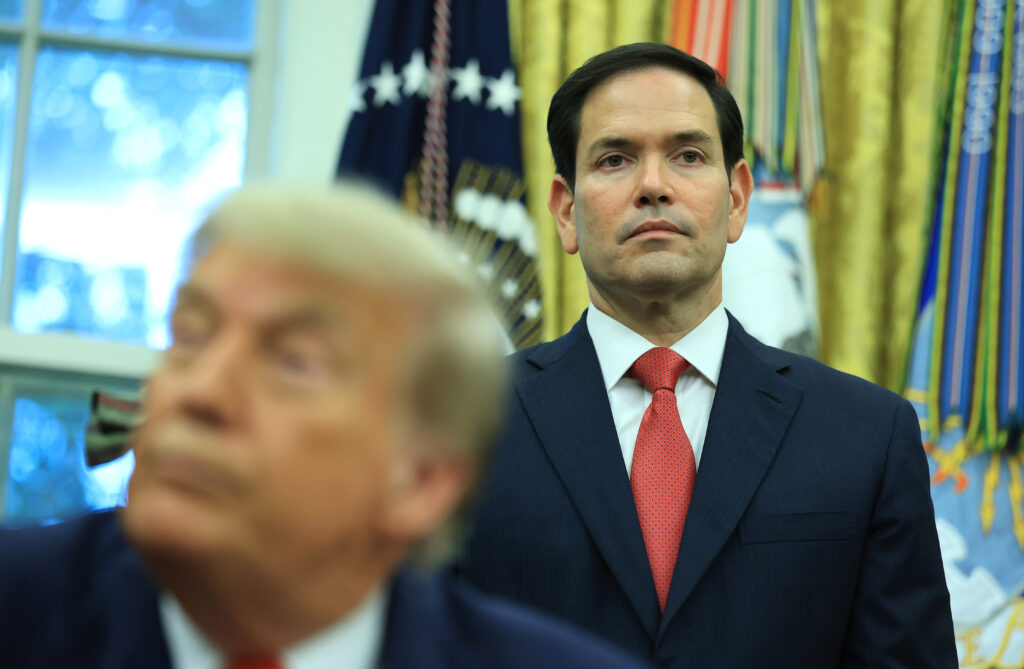

In January 2025, Trump signed an executive order declaring that critical minerals shortages threatened US national security, and he established the National Energy Dominance Council to streamline permitting and coordinate and accelerate domestic production. However, as the US is not well-endowed with all the critical minerals it needs, US Secretary of State Marco Rubio has emphasised the need to sign international deals.

“Everything we do is with the mission to build secure, well-governed and competitively priced supply chains for US industry and its allies,” Menell told the London Indaba in June. “We have chosen to be China-free, so we have no Chinese investment or counterparties.

“We seek projects that have potential to be low cost and compete with China. This is difficult, as China has become almost unassailable in economies of scale, incumbency and processing technology due to low costs and government subsidies. They are very formidable competitors. We have to focus on innovation, and do things differently, to compete.”

OVER THE RAINBOW

Out of TechMet’s 10 global investments across seven critical minerals, most are in North America or Europe but several are in developing countries. One is in South Africa (Rainbow Rare Earths), and there is one in Rwanda (Trinity Metals) and one in Brazil (Brazilian Nickel). TechMet is also assessing a project in war-torn Ukraine, the Dobra lithium deposit.

Rainbow Rare Earths is developing the first commercial recovery of rare earth elements from phosphogypsum contained in dumps at Phalaborwa, a byproduct of Foskor’s multi-year phosphoric acid production. It is busy with test work to improve the economic resilience of the project – which is already considered to be the highest-margin rare earth project in development outside China because it will use material that is already in a chemically cracked form.

Rainbow currently has sufficient funding to complete its definitive feasibility study by the end of this year. At the same time, it has begun an environmental assessment on an even bigger phosphogypsum/REEs project at Uberaba in Brazil, in partnership with The Mosaic Company. “We are happy with progress at Phalaborwa so far, though inevitably there have been delays as Rainbow has been investigating different processes to optimise separation and refining,” Menell says.

“Good work is being done and we are very confident it will be a big, viable project. We are a small shareholder and can become major shareholders when Rainbow is ready to seek further funding.”

He said the Uberaba project looked attractive, but was still at a very early stage.

UKRAINE LITHIUM

In April, the US and Ukraine signed a deal to establish a joint fund to invest in Ukraine’s natural resources, including not only rare earths but also oil, natural gas, gold and copper. Future US military assistance to Ukraine will count as the US contribution to that fund. The deal gives the US preferential, but not exclusive, access to Ukraine’s mineral resources.

On June 16, the New York Times reported that the Ukraine government had begun drawing up terms for a competitive bidding process over the Dobra lithium project. The project is in central Ukraine, south of Kyiv and well to the west of the areas under Russian control.

Menell said TechMet had been assessing the Dobra project since 2023 and had been working with the Ukraine government to ensure there was a transparent process over a production sharing agreement.

“We will be participating in the bidding, and we expect there will be other interested parties. Being part-owned by the US government may help us as a result of the formation of the joint US/Ukraine resource fund.”

He said there had been “reasonably extensive exploration work” on Dobra but more work was needed to define its scale and potential.

FUTURE STEPS

Menell said TechMet was supported by, and working with, a number of US funding agencies, and anticipated getting more funding from them for specific projects. “We are not planning to expand our list of seven target metals but will continue to look for opportunities in those sectors.”

He told the London Indaba that TechMet was underweight in Africa, and was willing to invest further in the continent, especially in nickel, where the medium-term outlook was compelling. “We will invest in low-or medium-risk countries where we are comfortable we can assess risks and have relationships,” he told the conference. “We seek governments that recognise that the 20-year supply disruption is an opportunity they have to earn by incentivising investment.

“Rwanda has been engaging and enabling although South Africa, where we are preparing to build a project, has quite a lot of historical baggage.”

At the Indaba, the South African government launched its own critical minerals strategy which contains, among other aspects, proposals to increase investments in exploration, domestic beneficiation, R&D and skills development. It proposes fiscal incentives, differentiated electricity tariffs and loan guarantees to support domestic processing, and a “one-stop shop” to facilitate licensing and permitting across the relevant government departments.

While the as-yet undefined fiscal incentives, differentiated electricity tariffs and loan guarantees are relatively fresh ideas, many of the others, such as the “one-stop shop”, have been on the cards since Minerals and Energy Minister Gwede Mantashe took office in 2018.

“The critical minerals strategy contains some good ideas that, if executed, would help us and other companies to increase the viability of our projects and make further investments,” Menell says. “Certainly, any resource-rich country that wants to attract investment needs to offer fiscal and regulatory certainty, and an enabling environment with cheap power and affordable labour.”