Of all the recent developments in the South African mining industry, the transformation of Harmony from JSE “dog” to “rock star” over the past 18 months has to be the most dramatic. From January 2024, the Harmony share price trebled to a peak of around R330 in April 2025 before pulling back to levels around R250 as of mid-June.

While the surge in the gold price has had a lot to do with this, the foundations of this turnaround were laid in 2016 when previous CEO Peter Steenkamp was appointed. The roots for what is still to come – the development of the Wafi-Golpu copper/gold project in Papua New Guinea (PNG) – date back to Steenkamp’s predecessor, Graham Briggs.

Newly appointed CEO Beyers Nel readily gives credit to his predecessors as well as to the booming gold price, without which he admits Harmony would not be in the sweet spot it is today.

Miningmx has pointed out on a number of occasions that Steenkamp was fortunate in having a favourable gold price from the time he took up his post, and those fair winds are continuing. At the current gold price of around $3,400 per ounce, Harmony is raking in just under R2m/kg on its gold sales, while its forecast ASIC (all-in sustaining cost) for the current financial year is R1.1m/kg.

But there’s a lot more to it than the gold price because you have to produce the gold in the first place to benefit from the price boom.

Nel – a Harmony ‘lifer’ who joined the group in 2003 – was appointed COO under Steenkamp in 2016, and he describes the time since then as the most rewarding part of his career so far.

“Prior to 2016, Harmony always overpromised and underdelivered. We were always lower on ounces and higher on costs. We overhauled the entire planning process, and I am super proud that since 2016 we have met guidance or beaten it, except for the year of Covid.”

Nel reckons that operating performance turnaround, with the favourable gold price and the acquisition of AngloGold Ashanti’s Moab Khutsong and Mponeng mines, are the three factors which – combined – resulted in Harmony’s rerating.

He believes a key part of the rerating came from the five-year wage deal that Harmony signed with the unions. Labour is Harmony’s largest expense, accounting for 55% of its cost basket, unlike many large gold operators outside SA where energy costs are dominant.

He comments: “We won’t see hyperinflation in our costs and, on a relative basis, Harmony has improved its cost performance far better than many other gold groups.

“We got the production machine to work while gold prices were high, and those two deep AngloGold Ashanti mines that nobody wanted now contribute 50% of Harmony’s operating cash flow as of today.”

Put it all together and that’s why the Harmony share price has trebled over a period when the share prices of industry gold leaders Newmont and Barrick have delivered lacklustre improvements.

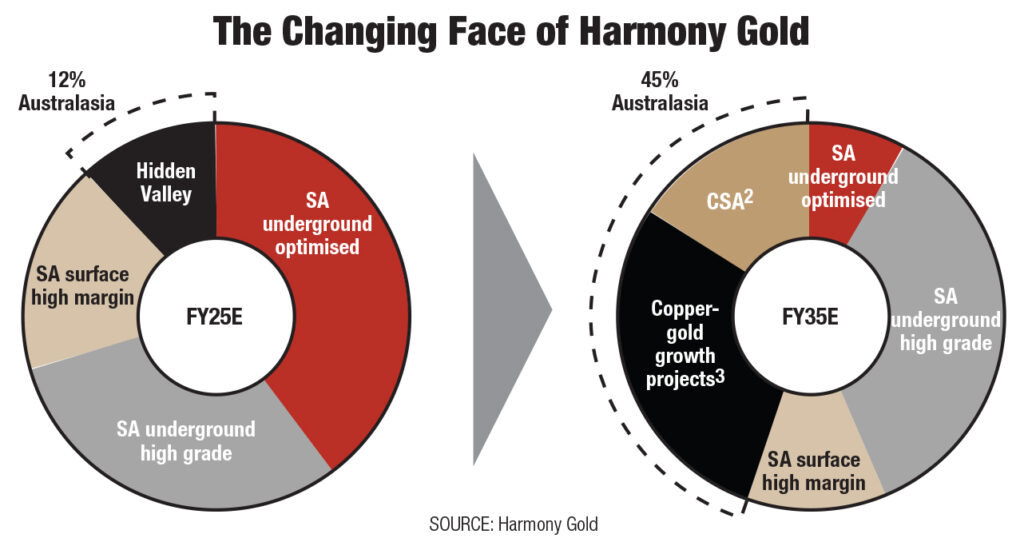

Next up is Harmony’s major diversification into copper, which Nel is set to deliver, following through on Steenkamp’s strategy.

He comments, “Mining is not the type of business where you can change the strategy every time you change the leader. It’s a long game. Harmony is on a good trajectory, and I am a great believer in, ‘If it ain’t broke, don’t fix it.’

“So I see my role as a continuation of the strategy. There will be tweaks here and there, but we have a clearly laid-out pathway.

“I see my key objective as to position Harmony with all the strategic steps we have taken in the medium term to build Wafi-Golpu. That is the big prize. If we can add Wafi-Golpu on top of the transformation that has already been done, then that really ratchets us up.”

Nel describes Wafi-Golpu as “a game-changing asset”, commenting: “Look at the scramble at the top of the mining industry to get copper assets. Look at the top dollar prices being paid.

“Wafi-Golpu is a tier-one bulk copper mine. It will be a block cave operation which, to a mining engineer, is the ‘gift that keeps on giving’ once it has been set up. That’s why Harmony is a strategic investment for ARM (African Rainbow Minerals). They see the value of Wafi-Golpu, but many others do not.”

Developments at Wafi-Golpu have been stalled at the permitting stage, apparently because of political issues, but Nel reckons resolution could be close. “We think we are close. There are one or two sticking points still to be ironed out, but I am confident we will get that special mining lease (SML) before the end of 2025.”

Some analysts believe the delay on the SML has done Harmony a favour because one of the longest-running debates over the project concerns Harmony’s ability to pay for its share. Wafi-Golpu is currently held 50/50 between Harmony and Newmont, but the PNG government has the right to take a stake up to 30%.

“With our market capitalisation now around $9.5bn, I think Harmony is in the best position it has ever been to participate in Wafi-Golpu,” says Nel. “I can understand why people would challenge Harmony’s ability to fund the project in Graham’s time, but Harmony is now a different company.”

Nel’s confidence is despite Harmony’s other major capex commitments, which are to extend the economic lives of the Mponeng and Moab Khotsong mines in South Africa and then build the Eva Copper mine in Australia. In addition to all this, Harmony has just bid $1.03bn cash for the MAC Copper mine, also in Australia, which is an operating mine that will generate cash flow from day one.

Nel does not foresee any problems, pointing out that Harmony is focused on using its cash windfall from the booming gold price responsibly. He comments: “Moab, Mponeng and Mine Waste Solutions all fund their own capital and create a surplus that flows back to the corporate kitty, so they don’t draw on our capital.

“Eva lies ahead and will draw on our capital, but we don’t foresee a problem funding that mine. MAC will kick into earnings from day one.”

So what happens to all these lovely prospects if the gold price suddenly pulls back? Nel reckons Harmony is ready for such a contingency.

“We are better positioned to take a drop in the gold price than we have been historically. The quality of our portfolio has improved such that our positioning on the cost curve is much better than it was.

“Previously, Harmony was at the top end of the cost curve and therefore the first to go underwater when the down cycle hit. We have also been disciplined in maintaining a hedging programme to protect our downside, and our planning has been done on very conservative gold prices.

“We have also weathered these cycles many times in my career. We know what levers to pull.

“If we can get through the next two or three years to add copper to our business, we will be less exposed to gold because the copper and gold prices tend to move in different directions.|