Expensive to hold and non-yielding, and yet a unique combination of economic and geopolitical forces has propelled gold to second in the ranks of the world’s most important monetary reserves.

That’s according to European Central Bank data that says bullion accounted for 20% of global official reserves last year, second only to the US dollar at 46%, and exceeding the euro (16%).

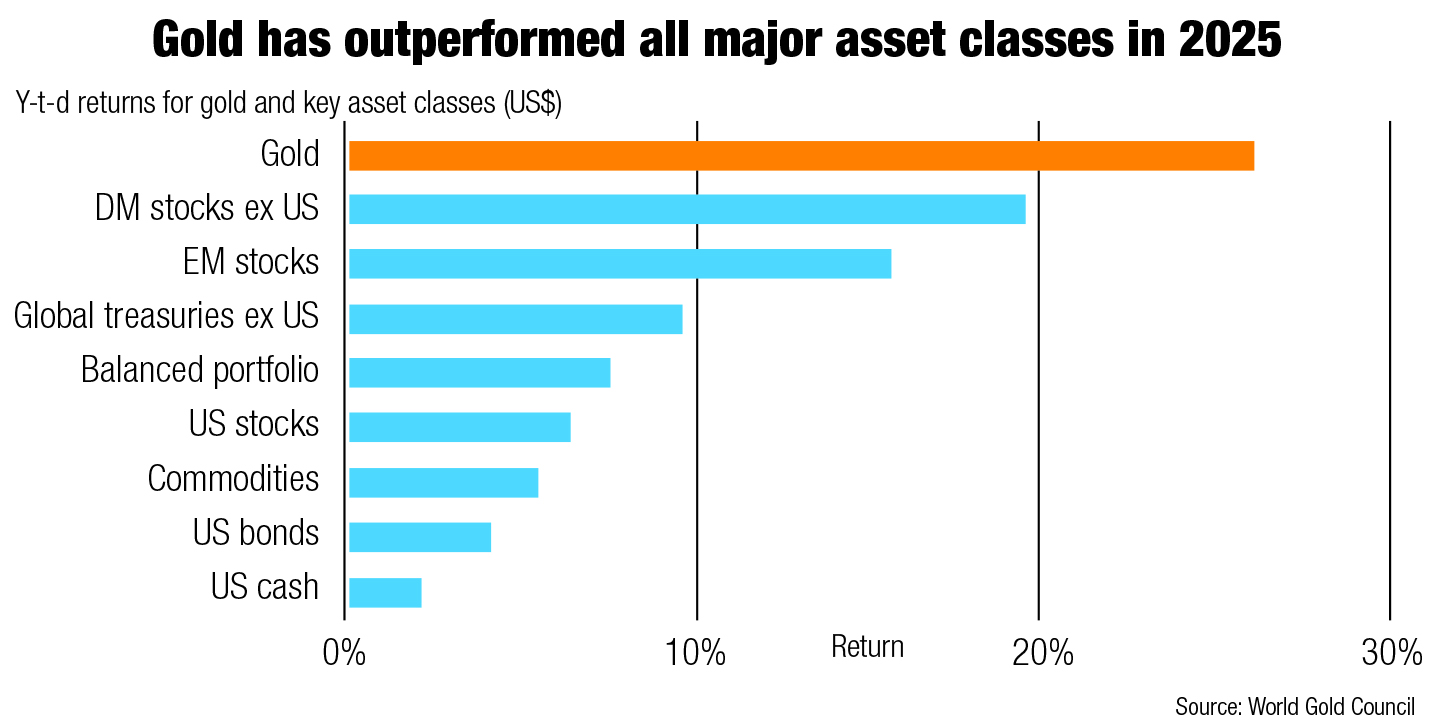

Gold’s seemingly inexorable rise has continued this year.

By the end of June, gold was one of the top-performing major asset classes, rising 26% over the period, according to the World Gold Council’s interim report, published in July. The metal also recorded 26 new all-time price highs during the period, having registered 40 new price highs last year. Given the rate of improvement in the metal’s price, the question is whether more gains are possible, or whether the current elevated gold price is here to stay.

Naturally, views on the topic are wide and varied (and probably doomed, as a history of gold price forecasting tends to show). Overwhelmingly, analysts agree that the factors that drove the metal’s price gains are likely to stay. These characteristics are a weaker US dollar, range-bound yields with an expectation of rate cuts by the Federal Reserve, possibly in the fourth quarter, as well as heightened geopolitical tensions – some of which are directly linked to US trade policy.

Central bank purchases of gold are also likely to continue, says Andries Rossouw, Africa energy, utilities and resource leader for PwC. “Gold is probably going to stay strong for some time still until we get a bit more peace in the world, or until various countries decide there’s an alternative to investing in gold in a risk-off position.”

“We are seeing a substantial increase in geopolitical stress and conflict and it is not clear that this will reduce in the short term,” says Andrew van Zyl, MD of SRK Consulting in South Africa.

This is already having spinoffs across the metals spectrum, says Van Zyl in what he terms “a constant struggle to create resilience”. Increased geopolitical tension and disruption to trade flows will “lead regions and countries to become more self-sufficient”, resulting in additional mining, processing and power generation, he says.

Central bank purchases of the metal have also filtered down to the institutional and retail sectors, as demonstrated in the trade flows of exchange traded funds (ETFs). By the end of June, global gold ETFs had increased 41% year-on-year (y/y) to $383bn. Total holdings rose 397 tons to 3,616t, the highest month-end level since August 2022. Jewellery purchases have also increased.

Improved demand for gold has not only vastly improved the revenues of the metal’s miners but also changed the outlook of the people who run them. In general, gold company CEOs have become expansive in their attitude to production by advancing projects.

Total mined gold production rose 0.6% y/y to 3,661t in 2024, reaching an all-time high, underpinned by growth in Mexico, Canada and Ghana, said Metals Focus, a UK-based market research company in a recent report. For this year, it forecasts gold mine output rising by 1% to a fresh record high of 3,694t as new mines come onstream.

Dealmaking in the gold sector was already a feature of 2023 and 2024. Of about 90 major mining deals last year, 60 were just in gold, with a value of nearly $20bn or two-thirds the value of all mining sector deals, according to a report by S&P Global. The gold deals, totalling $19.31bn, predominantly involved production-stage mining properties in Australia and Canada. That trend has so far continued this year.

AngloGold Ashanti announced a $111m offer for Augusta Gold, a Toronto-listed business that owns gold-bearing tenements in Nevada’s Beatty District. That was small beer compared to the $3.7bn Royal Gold agreed to pay for Toronto’s Sandstorm Gold and Horizon Copper. CMOC, a Chinese company, successfully bid $581m for Lumina Gold in April while Australian gold miner Ramelius Resources announced the $1.5bn takeover of Spartan Resources in March. Gold Fields is hoping investors approve its proposed A$3.7bn takeover of Gold Road Resources in the third quarter.

Commenting on where gold could lead the market this year, Philip Newman, MD of Metals Focus, said in the firm’s recent interim review that bullion would “break new ground in 2025”. He added: “Macroeconomic uncertainty and elevated geopolitical risks are likely to sustain investor interest. “While volatility and corrections are inevitable given speculative activity, we anticipate that dips will be bought, reinforcing an upward trend.”

Metals Focus forecasts a record average price of $3,210 – a level that would finally surpass the real-terms peak from 1980.

“Consensus expectations suggest a relatively steady finish for gold with moderate upside potential if macro conditions hold,” said the World Gold Council in its outlook. It added, however, that purchases of the metal by Chinese insurance companies, now enabled by local legislation to participate in the market, could be transformative to demand, and the price. A “more volatile geopolitical and geoeconomic scenario” could send gold “significantly” higher were there stagflation – slow or no growth and rising prices – the council said.

Nedbank Securities analyst Arnold van Graan has forecast $3,200/oz average for gold this year, falling to $3,000/oz in 2026 until a long-term retreat to $2,500/oz. While this sounds like one of the more conservative predictions, he is aware of gold’s ability to surprise. “We believe there is a high probability that gold could test against $3,500/oz again and may even make a run for $4,000/oz,” he says.

Perhaps the final word is due to the most philosophical. “Uncertainty is still the only certainty,” say Investec Securities analysts Nkateko Mathonsi, Peter Richardson and Ntebogang Segone in a recent report.

Commenting on a “bewildering array” of economic conditions, of which just one is the uncertain direction of tariff-setting by US President Donald Trump, “gold continues to be our preferred investment metal”, the bank said. “The continued attraction of gold as a diversifying asset for central banks, including the PBOC (People’s Bank of China) and the Bank of India, and its attraction as a long-term store of value in an increasingly polarised geopolitical environment remains very relevant,” it said.