DRDGOLD turned 130 this year, making it by far the longest-lived company listed on the Johannesburg Stock Exchange and – according to CEO Niël Pretorius – the company has “at least” another 15 years of life left, drawing on the two capital projects currently under way.

But there could be a lot more to DRDGold’s future than just the present expansions at its Ergo division on the East Rand and the new Far West Gold Recoveries (FWGR) operation on the West Rand, which is treating dump material from the former Driefontein, Kloof and Libanon mines.

“Hopefully, within those 15 years moreopportunities will arise so that maybe we can expand and extend. There’s lots of stockpile out there. Remember, Ergo was a 12-year project when we started it up in 2008,” says Pretorius.

Those opportunities lie both within South Africa and also north of its borders, particularly in Zambia where DRDGold is keen to get involved and has been making overtures – so far without success.

Pretorius comments: “I would love to go outside South Africa after the assets to the north of us. There are big companies operating there like Barrick Gold and AngloGold Ashanti that have fantastic operations but which are mature operations.

“I would love to partner on a venture optimising whatever is left from those operations from a tailings perspective. We are keen to get more copper and gold assets. We want to diversify and we are knocking on doors but, at this stage, we are not getting through the doors.

“Zambia is an increasingly attractive jurisdiction and there are loads of tailings there as well. If an opportunity presents itself we would be interested. We would like to play there. We have indicated our interest but so far there have been no takers. We will be good partners. We won’t embarrass you. Just ask Sibanye-Stillwater,” Pretorius says.

Sibanye-Stillwater is the controlling shareholder in DRDGold and holds the key to future potential diversifications and expansions into other metal recoveries, in particular platinum group metals (PGMs) and uranium.

It was the link-up with Sibanye that made the Far West Gold Recoveries

operation possible because Sibanye owned the mine dumps now being treated by DRDGold.

The cost of that deal was giving Sibanye control – which did not go down too well with some DRDGold investors at the time – but Pretorius reckons it was absolutely worth it. “At the time we had Ergo with a 15-year life but then there was nowhere else to go. The FWGR project was the best available in South Africa, if not the world, although we excluded the uranium assets from it up front to focus on the Libanon, Kloof and Driefontein cluster.

“Doing it required a leap of faith because Sibanye-Stillwater’s outgoing CEO Neal Froneman insisted on taking a controlling stake in DRDGold. Part of that arrangement involved Sibanye kicking in $80m with no strings attached to take full control. That was the largest, single investment ever made into DRDGold. The transaction has worked out very well.”

Froneman has since announced his retirement, to be replaced by former COO Richard Stewart, of whom Pretorius comments: “He’s the man that we negotiated the transaction with so he’s a known entity. I know him better than I know Neal Froneman.”

A key part of the plan was to look at diversification into recovering other metals – in particular PGMs – from Sibanye’s mature platinum mines which it had bought from the former Anglo American Platinum and Lonmin, but that has not worked out so far.

The reason lies in the complex corporate and BEE structures of the companies that Sibanye has taken over.

Pretorius comments: “The gold deal with Sibanye was easy. There was one shareholder. The platinum portfolio is made up of different subsidiaries purchased over time from a number of different companies, each of which has its own BEE structure.

“Also, the same orebody can be owned by different entities. Some people have an interest in just the chrome content. So it’s a very complex corporate structure which makes it just too hard to divvy up and put into one thing. It should eventually happen but there are practicalities that need to be dealt with.”

In terms of what happens next in South Africa, Pretorius stresses that DRDGold’s limited processing capacity means that it is not looking for joint ventures. It wants full ownership of anything it tackles.

“We have enough of our own material to fill our capacity for the next 15 years. We cannot dilute ourselves and we have to own 100% of what we treat.”

MANAGING SOUTH AFRICA

Pretorius has no worries about operating in South Africa despite the continuing issues between the mining industry and government. “What we do is determined by the quality of the orebody. After that question is settled then we look at what are the things that get in the way of exploiting the asset.

“Some may be insurmountable but the issues we face in South Africa are not insurmountable. They are annoying and they take effort but, add it all up, and you can still do incredibly well here. Just ask Harmony.

“South Africa is a constitutional democracy. We will not go into a country that does not have a system of checks and balances like we have here.”

DRDGold has also been careful not to overextend itself in what it has tackled. It acquired control of the Ergo tailings operation by kicking in capital to increase its equity stake as former controlling shareholder ASX-listed Mintails got into financial trouble and could not meet its capital commitments to the project.

But DRDGold shied away from the Mine Waste Solutions project subsequently acquired by Harmony, which has developed it.

Pretorius comments: “We looked at Mine Waste Solutions but it was going to require a lot of capital and we just did not have the capacity to do that. Plus at the time MWS was subject to a very onerous gold hedge and we were not going to bring that into our business.”

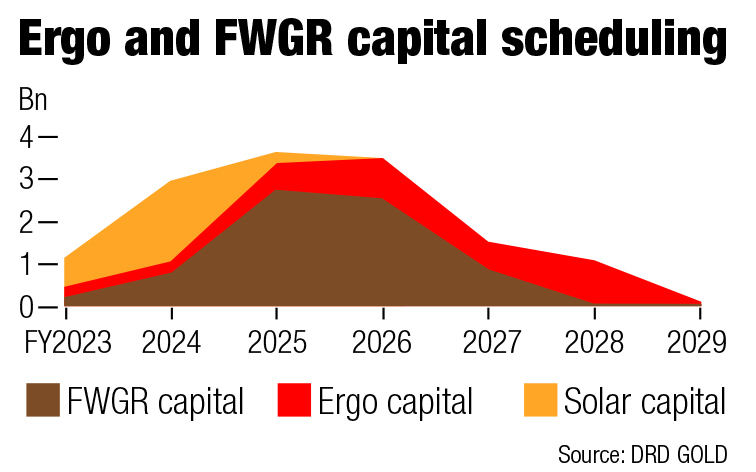

The booming gold price has greatly helped DRDGold in its current expansion phase, which has involved spending some R10bn in capex to complete the FWGR operation and build a solar energy plant at Ergo.

That campaign is now in its second financial year, with Pretorius commenting that DRDGold had expected to be in a net debt situation at this stage. Instead, the company still held cash of R661m at end-December despite a net cash outflow of R964m on investing activities. “The situation has been unprecedented,” says Pretorius. “Way beyond our expectations and we have accelerated our capital expenditure but it is harder to spend money than you would think.

“All the pipes required have been bought and are in the yard. The big capital spend comes this year – year two – and then we will be over the hump. Year three capex will be high but a lot less than this year.”

This expansion has come at the cost to DRDGold shareholders of what can only be described as “stingy” dividends despite the gold price boom, but Pretorius maintains it will be worth it.

He told an investor presentation in August last year that: “Three years from now when we are not spending R2bn to R3bn a year in capital and we have a different revenue profile with a relatively attractive cash cost profile, then – you run the numbers. We can make up for the dividends.”